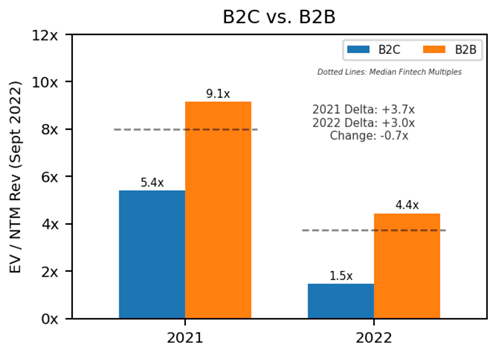

We observe that companies that are primarily B2B (vs B2C) see a consistently higher EV/NTM rev multiple

Appendix

Starting with the north stars:

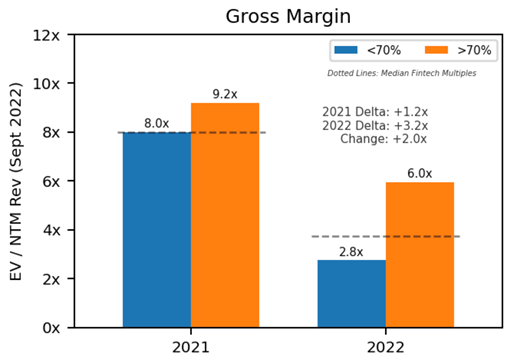

Companies with gross margin > 70% consistently see a higher EV/NTM rev multiple, and gross margin matters even more in 2022 than it did in 2021

Companies with revenue growth between 20% and 60% (not too slow, not too fast), consistently see higher valuation multiples

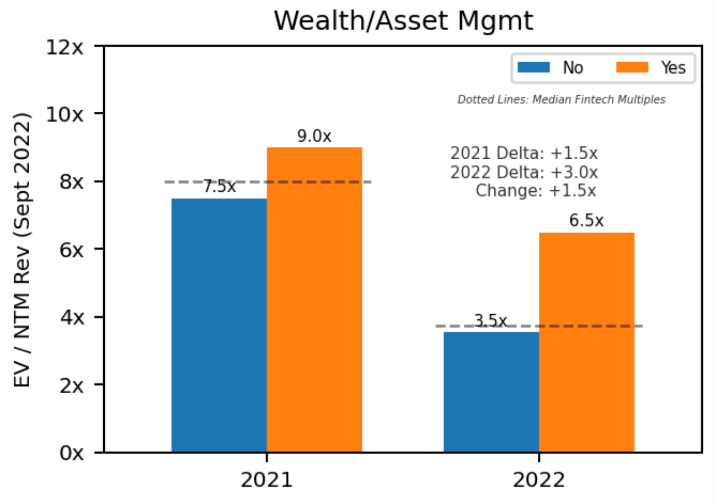

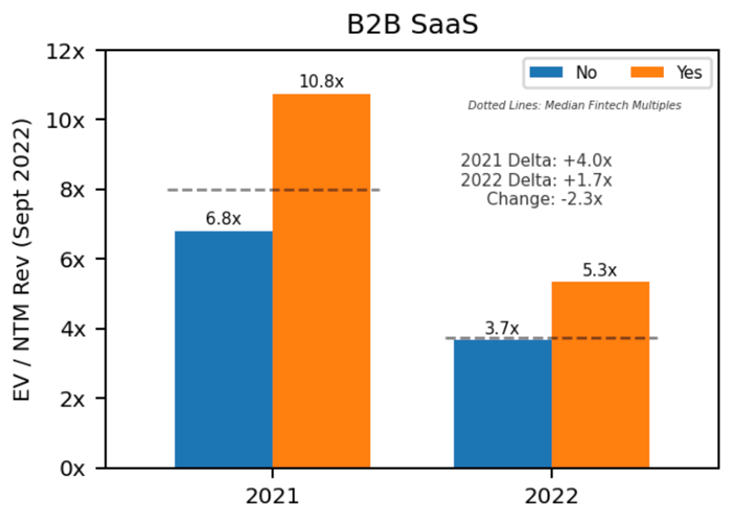

Companies in the wealth/asset management and B2B SaaS markets consistently see higher valuation multiples

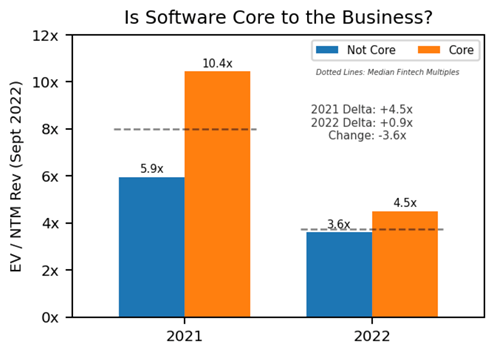

Companies with software core to the business saw higher multiples in both 2021 and 2022 though the gap narrowed in 2022

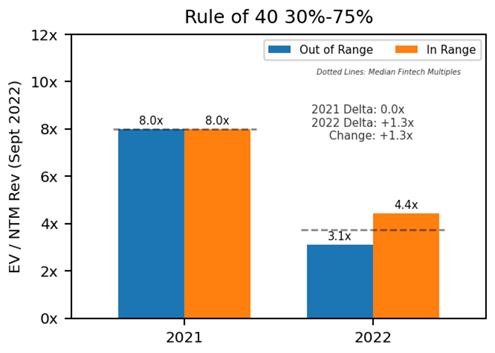

Companies meeting at least the Rule of 40 threshold at 30% were more highly valued in 2021 and 2022, but the benefit was less significant in 2022

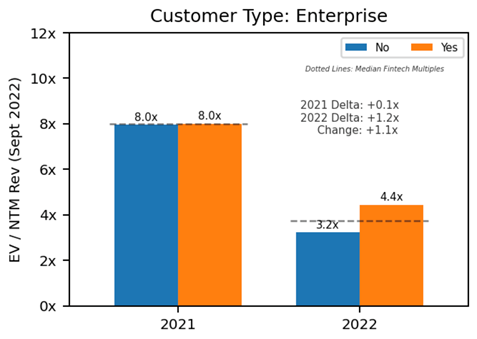

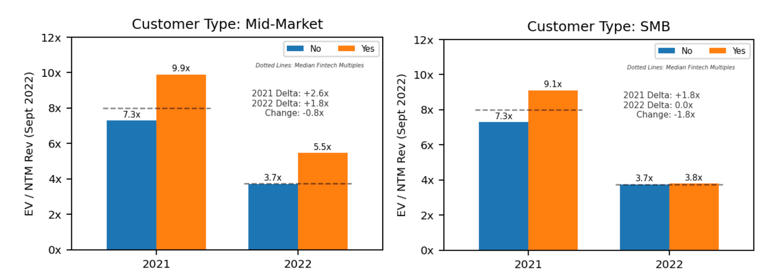

The impact of type of business customer segment on multiples was also consistent over time: mid-market performed best over time, but in 2021 SMB was valued more highly than enterprise, which then flipped in 2022 where mid-market was the most highly valued

Next, moving to the sinkholes, or the characteristics that have been consistently correlated with below median multiples:

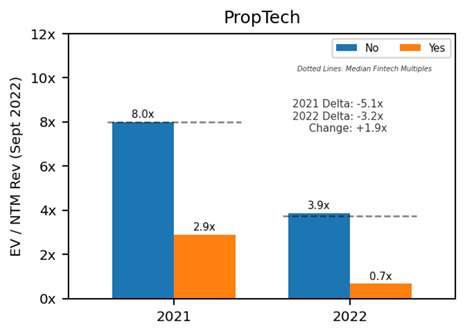

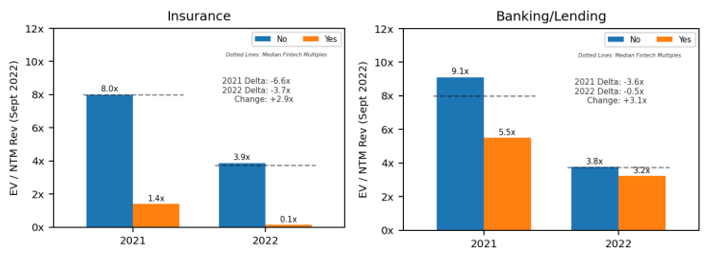

In both 2021 and 2022 proptech, insurtech, and banking/lending companies saw lower than the median multiples. Among these sectors, banking/lending companies consistently outperformed proptech and insurance companies

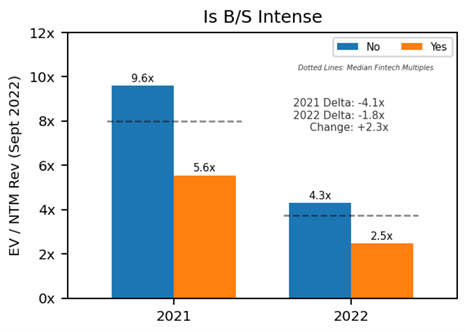

The more balance sheet intense a company’s business model, the lower the multiple, in both 2021 and 2022

Finally, turning to the characteristics of companies that flipped in significance between 2021 and 2022. Some characteristics, the oases, were associated with low multiples, but became correlated with high multiples. Other characteristics, the sandtraps, were associated with high multiples, but then emerged in 2022 as correlated with low multiples. It was as if we were on a trip and thought we were in the desert and then all of a sudden ran into a lush oasis with water and plants, or we were in a nice, manicured field and all of a sudden ran into a sandtrap. Of course this felt very disorienting for all of us. To go through each of these:

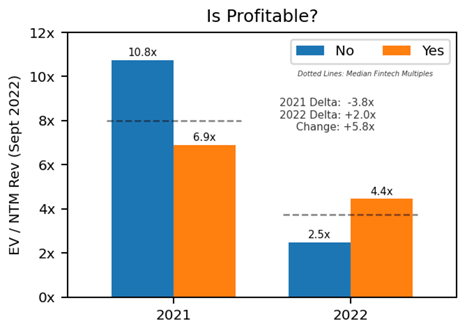

Unprofitable companies attracted higher multiples in 2021, but then profitable companies attracted higher multiples in 2022

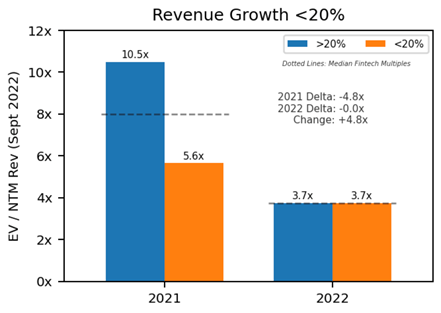

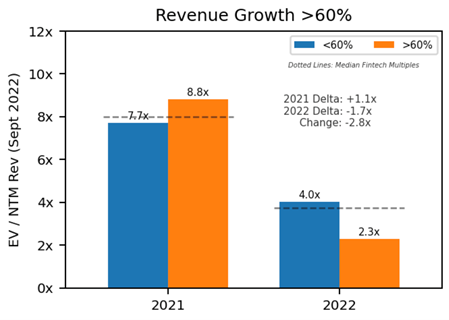

In 2021 the faster the growth, the better, whereas this flipped in 2022. Specifically, companies growing less than 20% were valued less in 2021, but then those companies growing more than 60% were valued less in 2022. As shown in the north star section above, those growing between 20 and 60% were consistently the highest valued

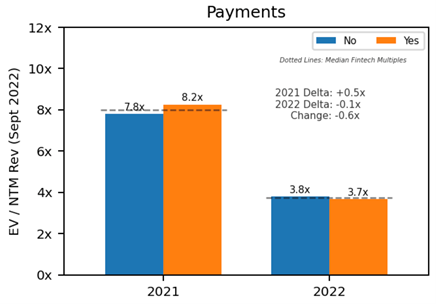

And a note on payments companies: while there was no notable difference in valuation multiple in 2022 depending on whether a company is a payments company or not, payments companies performed better in 2021